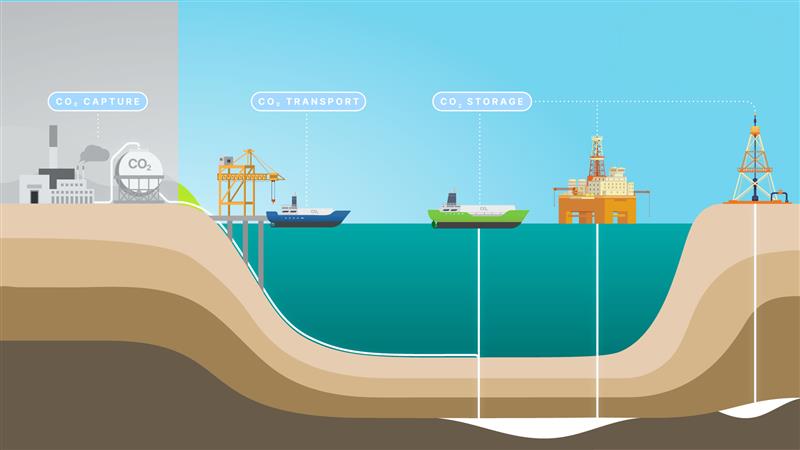

Six primary steps for CO2 value chain

CCS value chain involves several critical stages, each playing a key role in reducing CO₂ emissions:

Capture

The process begins at large emission sources, such as cement factories, steel plants, or power stations, where CO₂ is produced as a byproduct. Instead of releasing this CO₂ into the atmosphere, it is captured using advanced technologies, preventing it from contributing to greenhouse gas emissions.

Compression and Temporary CO2 Storage

Once captured, the CO₂ is compressed into a liquid form for easier handling and transport. This temporary storage is a critical step to ensure the CO₂ is manageable and ready for its next phase.

Carbon Transport

Transporting CO₂ to a storage site is typically done through pipelines laid on the seabed or onshore. Alternatively, for offshore storage locations, CO₂ can be transported by specialised ships. The choice of transportation depends on the location of the storage site and logistical considerations.

CO2 Storage Site Selection

The storage phase involves identifying suitable geological reservoirs for long-term containment. These reservoirs can be depleted oil and gas fields or other geological formations deemed fit for CO₂ injection. A critical part of this stage is assessing the integrity and capacity of the storage site.

Well Preparation and Carbon Injection

Injection wells are drilled into the selected reservoir to deposit the CO₂ deep underground. For reservoirs that have previously been used for oil and gas production, existing wells need to be carefully examined and potentially repurposed. Ensuring these wells are properly plugged and secured is vital to prevent CO₂ from leaking back to the surface or seabed.

Monitoring and Maintenance

Post-injection, the site undergoes rigorous monitoring to ensure the CO₂ remains safely stored and that the storage system performs as intended. This long-term oversight is critical to the success and safety of CCS operations.

Why is CCS momentum building?

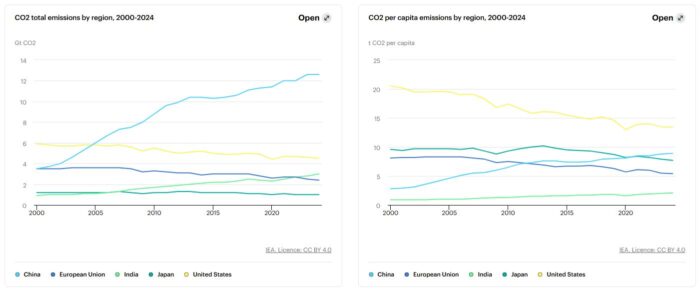

The growing momentum behind Carbon Capture and Storage (CCS) is driven by the urgent need to address global CO2 emissions, which continue to rise despite reductions in some regions.

Source: Global Energy Outlook 2025 CO2 Emissions – IEA

We have yet to reach a peak in global emissions, making it clear that current efforts are not sufficient to meet climate targets. To close this gap, scalable and effective solutions like CCS are essential.

As countries and industries recognise the critical role of CCS in reducing emissions, momentum is building to implement this technology at scale. CCS is increasingly viewed as a necessary component of a comprehensive strategy to tackle climate change and meet the goals of the Paris Agreement. The focus is no longer just on reducing emissions but also on actively removing and managing CO2, ensuring a sustainable future.

There has been a notable increase in investments in energy transition and renewables over the past decade, reflecting a clear shift towards more sustainable energy sources beyond oil, gas, and coal for power production. An increasing trend is particularly evident within CCS, which saw its investments nearly double from 2022 to 2024, with even further growth anticipated this year. This surge in funding underscores the growing commitment to advancing technologies that support the global transition to a low-carbon future.

Looking at various financial and industrial reports, we conclude that:

- Annual global investment in energy transition technologies rose to USD 1.77 trillion in 2023 – 17% year-on-year gain

- Investments in new renewable energy projects – wind, solar, biofuels and other renewables – grew 8%

- Hydrogen tripled to USD 10.4 billion

- CCS nearly doubled to USD 11.1 billion.

The UN climate negotiations under COP29, launched last year in Baku, Azerbaijan, further underscored the urgent need to mobilise substantial investments to meet the escalating global climate bill.

What’s the status of CCS globally?

Globally, numerous CCS projects are in various stages of feasibility, development, construction, and operation. As of February 2025, data from the Global CCS Institute shows that 65 CCS facilities are operational with a combined capacity of 57.38 million tonnes per annum (Mtpa). An additional 42 facilities are under construction (44.39 Mtpa), while 272 projects are in advanced development (215.95 Mtpa), and 336 are in early development with a projected capacity of 130 Mtpa.

By 2070, it is projected that 15% of the total CO2 reduction required to achieve climate goals will need to come from CCS technologies.

CCS in the US

The successful deployment of large-scale CCS hinges on robust policy frameworks, including carbon pricing, tax incentives, and emissions regulations.

In the U.S., the enhanced 45Q tax credits for the CCS projects under the Inflation Reduction Act, increased the credit to $85 per ton of CO₂ captured and permanently stored (up from $50) and $60 per ton for utilisation (CO2-EOR) (up from $35).

In July 2025, the U.S. government reaffirmed its commitment to Carbon Capture and Storage (CCS) by preserving – and in some cases enhancing – the federal Section 45Q tax credit. This support was formalised through the “One Big Beautiful Bill Act,” reinforcing CCS as a cornerstone of the nation’s long-term climate and energy strategy. We see new projects emerging across the Gulf Coast and Midwest.

CCS in Australia

Australia has currently two large CCS projects in operation; Chevron Gorgon CCS (designed to store up to 4 Mtpa) and Santos Moomba CCS project (targeting 1.7 Mtpa). Another recent interesting example of development in CCS is the awarding of two Greenhouse Gas Assessment Permits in the Bonaparte Basin and Timor Sea. These sites have the potential to permanently store up to 1 giga billion tonne of CO2. The project represents a full value chain solution, encompassing the receipt of liquefied CO2 (LCO2) from locations in Japan, Australia, and the surrounding region, its transportation by ship, and subsequent storage and injection via floating storage and injection (FSI) facilities in Australian waters. An appraisal well for this project is planned to be drilled in 2026.

As of late 2023, Australia amended its legislation to allow the import and export of CO₂ for geological storage, marking a major step forward in enabling transboundary CCS projects.

CCS in Europe

The recent proposal by the European Commission for a legally binding 90% reduction in greenhouse gas emissions by 2040 marks a pivotal moment in climate policy – reinforcing the essential role of Carbon Capture and Storage (CCS) in achieving climate neutrality across hard-to-abate sectors.

In a significant milestone for European climate action, Norway finalised the pioneering Longship project, the country’s full-scale carbon capture and storage (CCS) initiative. As part of this achievement, the Northern Lights CCS facility – a key component of Longship – received its first shipment of captured CO₂, marking the start of operations for Europe’s first open-access, cross-border CO₂ transport and storage infrastructure. Looking ahead, the Phase 2 expansion of Northern Lights is set to increase its capacity from 1.5 million to at least 5 million tonnes of CO₂ per year, reinforcing Norway’s leadership in scalable, secure carbon storage solutions.

As part of the UK’s 2025 Spending Review, the government allocated £25 million in targeted funding to advance carbon capture and storage (CCS) technologies and projects. This investment supports the development of key CCS clusters in the country.

HyNet North West and Bacton Thames NetZero each aim to store up to 10 million tonnes of CO₂ annually by 2030.

Across Europe, momentum continues to build: the L10CCS project in the Netherlands targets 5 million tonnes per year, while a future expansion of Italy’s Ravenna CCS hub could contribute an additional 4 million tonnes annually, reinforcing the region’s commitment to scalable climate solutions.

Last year saw important declarations, including an agreement between Denmark, Norway, Belgium, the Netherlands, and Sweden to facilitate cross-border transport and geological CO2 storage.

In late 2024, six EU member states advocated for a comprehensive regulatory framework to facilitate cross-border CO₂ transport – an increasingly critical component of Europe’s carbon capture and storage (CCS) strategy, given the geographic separation between major emission sources and CO2 geological storage sites.

What’s next for CCS?

CCS is essential for reducing greenhouse gas emissions (GHG), with projections indicating that by 2070, we will need to manage 50% of global emissions through this technology.

Globally, CCS activity is ramping up, with investments doubling from 2022 to 2024 and continuing to rise. The U.S. contiues to lead and has a long history of utilising CCUS, and technically, we have the capability to scale this solution.

In Europe, while there is significant storage potential, the challenge lies in capturing and transporting CO2 from major emission sources to suitable storage locations. Many capturing and storage projects are already underway or in the pipeline, with the UK, Norway, the Netherlands, and Denmark leading the way. Notably, Denmark is focusing on onshore storage as well, emerging as a key alternative to offshore storage solutions.

As the world works to meet its climate goals, CCS will play a central role in achieving net-zero emissions. The future of CCS looks increasingly promising, with growing investments and a global push for scaling this critical technology.

Working across the full Carbon Transport and Storage spectrum

At AGR, in collaboration with our sister company Longitude, we operate and maintain CCS projects over the entire value chain – from vessel evaluation, transportation, subsurface through to full drilling project management and third-party risk assessment, asset repurposing and to ensure CO2 remains underground.

With 17 CCS projects delivered in 2024, we are well-connected to offer support in key CCS stages:

- Feasibility studies – including petrophysics, reservoir modelling and simulation of CO2 plume movement, CO2 well costing

- Storage site screening and characterisation for potential CO2 storage

- Independent third-party project risk evaluation and storage evaluations

- Geological assessment and mitigation of the risks associated with CO2 leakage

- Subsurface evaluation in certification for CO2 storage sites according to ISO27914

- Evaluation of repurposing production wells to CO2 injection wells

- Well integrity assessments for depleted oil and gas fields to be converted to CO2 storage sites

- Well design and drilling management of CO2 storage wells

- Vessel design and engineering for CO2 transportation